When shopping a home with much less than a 20% down rate, lenders regularly require borrowers to achieve Private Mortgage Insurance (PMI). This type of insurance protects the lender in case the borrower defaults on the loan. For many homebuyers, specifically first-timers, PMI can also want to make the distinction among being capable of give you the cash for a home or no longer. In this text, we’ll walk through the technique of acquiring non-public loan insurance and the manner it influences your loan adventure.

What Is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance is an insurance insurance that protects lenders whilst a borrower locations down less than 20% on a home purchase. While PMI benefits the lender, it presents a similarly fee in your month-to-month loan fee. PMI allows lessen the danger for lenders, making it feasible for borrowers to advantage a mortgage notwithstanding a smaller down price.

Why Do Lenders Require PMI?

Lenders require PMI due to the reality loans with low down bills are taken into consideration riskier. A lower down rate manner that the borrower has much less equity inside the home, and within the event that they default, the lender is more likely to lose cash. PMI gives the lender with economic protection, ensuring that they will be reimbursed if the borrower can’t pay off the mortgage.

For debtors, PMI makes it viable to buy a home even as no longer having to hold up for a big down charge. Although PMI affords a similarly charge, it lets in homebuyers to get into the housing marketplace quicker, doubtlessly profiting from developing home charges and building fairness.

When Is PMI Required?

PMI is usually required whilst a borrower makes a down price of plenty plenty much less than 20% of the residence’s purchase fee. This applies to standard loans, which can be loans that are not insured or assured thru the federal authorities.

It’s vital to be conscious that PMI isn’t required for all forms of loans. For instance, FHA loans (Federal Housing Administration loans) have their non-public loan coverage necessities, which can be one-of-a-kind from PMI. Borrowers doing away with a VA loan or USDA loan are also no longer trouble to PMI, although those loans have their very own unique terms and fees.

How Long Do You Need PMI?

PMI is not a everlasting requirement. Once a borrower has paid down enough in their loan to gain 20% equity in the home, they are able to request that the lender cancel PMI. By law, creditors are required to eliminate PMI while the loan stability reaches seventy eight% of the home’s unique charge.

Borrowers can boost up this machine via the use of making greater payments at the loan or thru growing the rate of their home through renovations or marketplace appreciation. However, it’s crucial to verify the terms together in conjunction with your lender concerning PMI cancellation.

How to Get Private Mortgage Insurance

Now that we’ve protected what PMI is and whilst it’s required, allow’s dive into the steps of obtaining it. The gadget of getting PMI is generally handled thru your lender, however it’s important for debtors to recognize how PMI is calculated and what options they’ve got.

1. Choose a Lender that Offers PMI

When attempting to find a loan, you’ll want to art work with a lender that gives options for borrowers who need PMI. Most traditional lenders offer PMI for traditional loans, so this shouldn’t be tough. During the software program application method, make certain to invite about their PMI phrases, as each lender may fit with extraordinary mortgage coverage corporations.

2. Compare PMI Premiums

PMI is commonly calculated as a percent of your loan amount. The top fee can range from 0.Three% to 1.Five% of the mortgage every year, counting on factors together collectively with your credit rating rating rating, the dimensions of your down fee, and the mortgage amount.

For example, in case you’re borrowing $two hundred,000, PMI might also want to rate anywhere among $600 to $3,000 in step with twelve months. It’s critical to take a look at PMI costs from multiple creditors to make sure you’re getting the incredible deal.

3. Understand How PMI is Paid

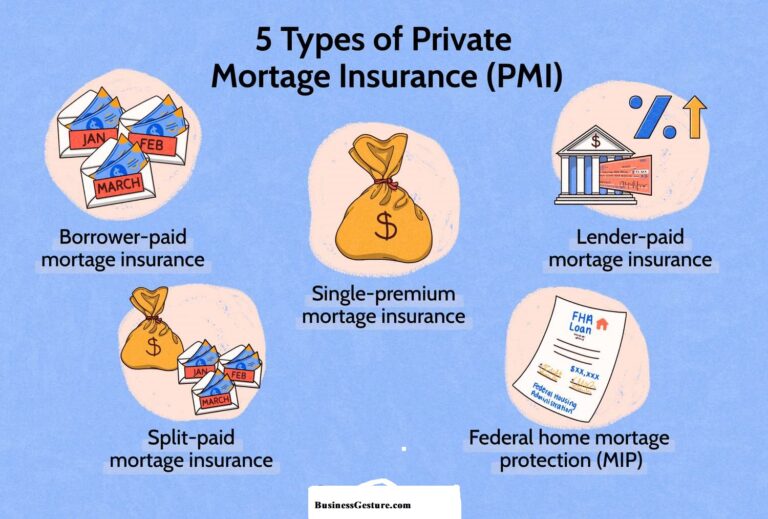

There are numerous strategies that PMI may be paid, and it’s vital to apprehend the ones alternatives in advance than moving beforehand with a lender.

- Monthly Premiums: This is the most commonplace manner of paying PMI. The pinnacle magnificence is introduced to your month-to-month mortgage fee, making it a part of your regular housing costs. This should make budgeting much less complex, because of the truth the prices are unfold out over time.

- Upfront Premium: Some creditors allow borrowers to pay the PMI pinnacle charge in advance, each in entire or as a partial price. Paying upfront technique that you won’t have PMI delivered for your month-to-month mortgage charge, but it does require a larger out-of-pocket rate at closing.

- Combination of Upfront and Monthly: In a few instances, debtors will pay a portion of the PMI in advance and the rest in month-to-month installments. This hybrid possibility allows to lessen each the prematurely costs and the amount delivered to monthly payments.

4. Improve Your Credit Score

One of the elements that determine your PMI price is your credit score score rating. The higher your credit score rating rating, the decrease your PMI fees may be. Before utilising for a loan, it’s a exceptional idea to look at your credit score score rating record and take steps to enhance your rating if important.

Improving your credit rating can consist of paying down modern-day debt, correcting mistakes in your credit rating report, and keeping off any new credit rating score inquiries within the months essential up for your mortgage application. Even a small development to your credit score rating score may want to make a big difference in your PMI charges.

5. Make a Larger Down Payment if Possible

While PMI is generally required at the identical time as you positioned down an awful lot less than 20%, it’s critical to endure in thoughts that the bigger your down price, the lower your PMI expenses might be. For example, if you could manipulate to pay for to place down 10% in choice to 5%, your PMI costs will in all likelihood be lower due to the reality you’ll be borrowing masses an awful lot much less money and pose a smaller risk to the lender.

Making a bigger down rate now not satisfactory reduces your PMI fees but moreover facilitates you collect equity in your home faster, likely permitting you to cancel PMI quicker.

Reducing or Canceling PMI

PMI doesn’t final for all time, and after you’ve built up sufficient equity in your private home, you could reduce or eliminate this greater charge. Below are some strategies to lessen or cancel PMI through the years.

Reaching 20% Equity

As stated earlier, PMI can be canceled as soon as you have got were given 20% fairness in your property. Keep a watch in your mortgage balance and speak on your lender while you take delivery of as actual with you’ve reached this milestone. Be organized to provide an updated domestic appraisal if your house has desired in charge thinking about that to procure it.

Making Extra Payments

If you have got were given the financial approach, making more bills on your mortgage can help you assemble equity faster and acquire the 20% threshold faster. Even small extra bills every month should make a huge distinction over time.

Refinancing Your Mortgage

If you’re no longer able to make more payments, some exceptional preference is to refinance your loan as soon as your private home’s charge has stepped forward. Refinancing permit you to get a higher interest rate and can additionally dispose of the need for PMI if your house has desired enough to offer you 20% equity.

Conclusion

Private Mortgage Insurance is a critical price for loads homebuyers who need to buy a domestic with a great deal much less than a 20% down charge. While PMI provides to your monthly housing expenses, it moreover opens the door to homeownership for customers who may not otherwise be able to have sufficient money a huge down fee.

By information how PMI works, buying around for the first rate charges, and taking steps to improve your credit rating and down charge, you can lessen the costs related to PMI. Additionally, through staying on pinnacle of your mortgage stability and making greater bills even as feasible, you may art work in the path of canceling PMI and reducing your common housing expenses.

Whether you’re a primary-time patron or looking to shop for your next home, know-how a way to navigate PMI is an crucial a part of the mortgage device.